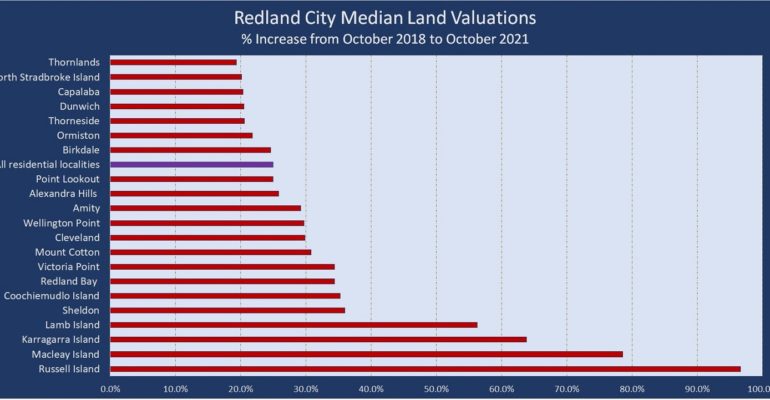

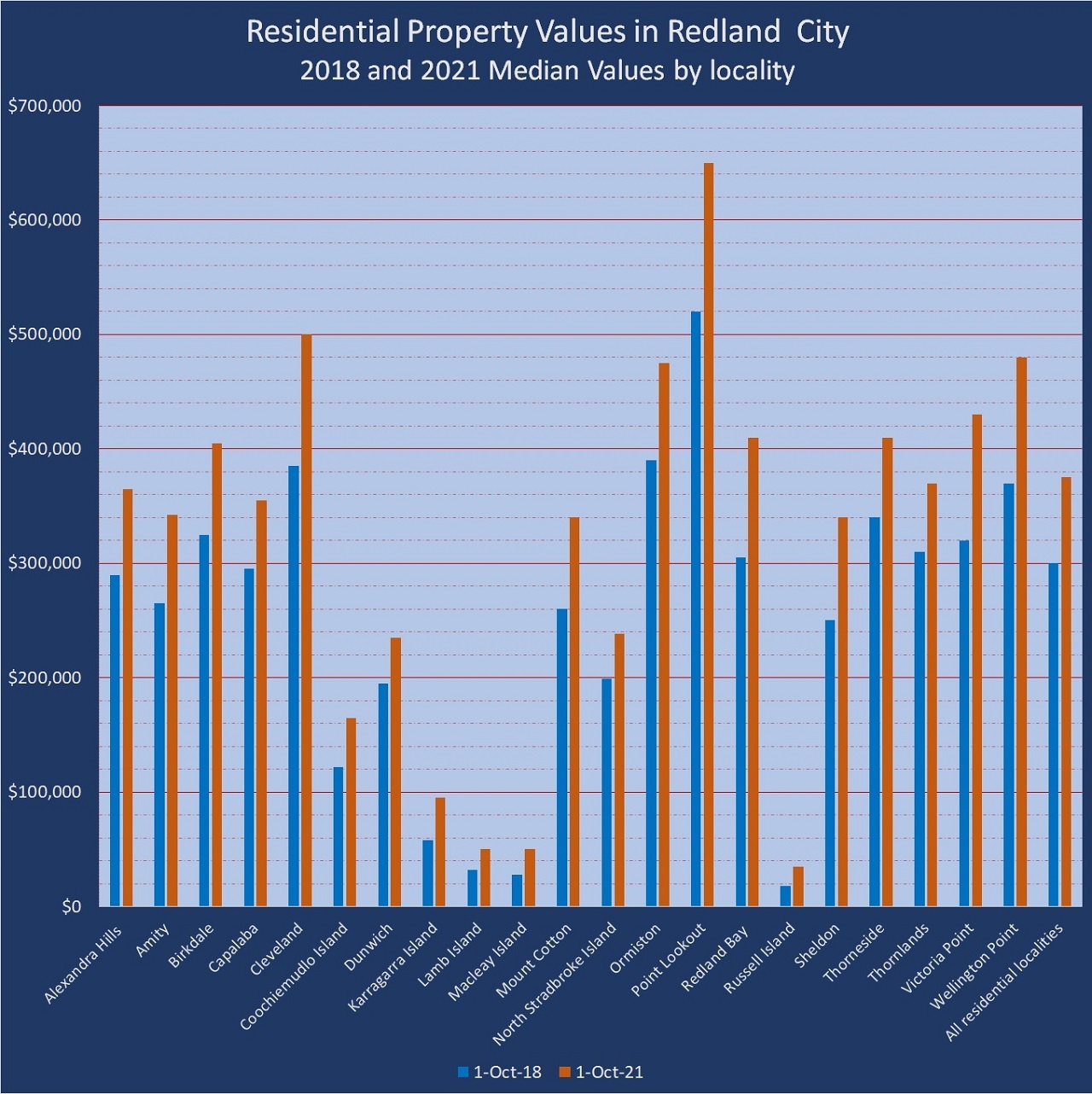

Southern Moreton Bay islands have recorded big percentage increases in land valuations over the past three years including a 96.6% increase for Russell Island and a 78.6% increase for Macleay Island.

Mainland localities recording valuation increases over 30% include Redland Bay (34.4%), Victoria Point (34.4%) and Mount Cotton (30.8%)..

Across all of Redland City, the median land value of 56,692 residential properties increased by 25% from 1 October 2018 to 1 October 2021.

Details of increases to median valuations of residential properties in Redland City is contained in a report published online by the State Government:

Land valuations overview: Redland City Council

| Locality | 2018 | 2021 | Properties | % Change |

| Alexandra Hills | $290,000 | $365,000 | 5642 | 25.9 |

| Amity | $265,000 | $342,500 | 344 | 29.2 |

| Birkdale | $325,000 | $405,000 | 4548 | 24.6 |

| Capalaba | $295,000 | $355,000 | 4462 | 20.3 |

| Cleveland | $385,000 | $500,000 | 4417 | 29.9 |

| Coochiemudlo Island | $122,000 | $165,000 | 668 | 35.2 |

| Dunwich | $195,000 | $235,000 | 387 | 20.5 |

| Karragarra Island | $58,000 | $95,000 | 203 | 63.8 |

| Lamb Island | $32,000 | $50,000 | 622 | 56.2 |

| Macleay Island | $28,000 | $50,000 | 3247 | 78.6 |

| Mount Cotton | $260,000 | $340,000 | 2063 | 30.8 |

| North Stradbroke Island | $198,750 | $238,750 | 4 | 20.1 |

| Ormiston | $390,000 | $475,000 | 1849 | 21.8 |

| Point Lookout | $520,000 | $650,000 | 710 | 25.0 |

| Redland Bay | $305,000 | $410,000 | 5596 | 34.4 |

| Russell Island | $17,800 | $35,000 | 6405 | 96.6 |

| Sheldon | $250,000 | $340,000 | 5 | 36.0 |

| Thorneside | $340,000 | $410,000 | 1012 | 20.6 |

| Thornlands | $310,000 | $370,000 | 5469 | 19.4 |

| Victoria Point | $320,000 | $430,000 | 4784 | 34.4 |

| Wellington Point | $370,000 | $480,000 | 4254 | 29.7 |

| All residential locations | $300,000 | $375,000 | 56692 | 25.0 |

Land valuations and Council rates

The site value of properties is determined by the State Government’s Valuer General and advised to each property owner. Valuations can be checked on line.

Valuations are used by local councils as a guide to determine what to charge in general rates, and for state land tax and state land rental amounts.

If increases in land valuations are not uniform across the city then properties with above average increases may get above average increases in general rates. The opposite may apply for properties with below average increases in valuations.

Some local councils in south east Queensland, such as Brisbane City Council, use an average of valuations over the past three years to calculate rates which ensures that the effect of changing valuations is reduced year on year.

The impact of valuations will be a factor in Redland City Council’s rates for 2022/23 scheduled for discussion during the Special Budget Meeting on 23 June 2022.

Objecting to land valuations

The new valuations become effective on 30 June 2022.

Any property owner can lodge an objection to valuations issued by the Valuer General.

The 60 day objection period for the 2022 land valuations closes on 30 May 2022.

Increase in residential properties

The number of residential properties in Redland City increased by 511 (9.1%) between 1 October 2018 and 1 October 2021.

Localities which experienced the greatest growth in the number of residential properties were Thornlands (380) and Redland Bay (166).

The 2018 land valuations

We wrote about the 2018 valuations in Alex Hills tops Redlands land value increases.

Redlands2030 – 1 April 2022

Please note: Offensive or off-topic comments will be deleted. If offended by any published comment please email thereporter@redlands2030.net

3 Comments

These Rate increases are totally WRONG. I purchased my property in 1991 and built a house so I can have a safe and healthy future. Council has NOT delivered any support to residents,, JUST continually steals money via a government policy.. This property is my property and Council has NO right to steal from residents,, UNDER NO CIRCUMSTANCES!!!! When I buy any article I pay GST once when i make the purchase,, not every three months every year. My latest Rates water consumption was just under $20-00 but my water bill is over $360-00. If that is not outright THEFT,, then we are slowly heading for a Communist style Queensland Government

heading for a communist style

government? Seems we are already in one since our voices are never heard nor can we attend public meetings without applying as I understand it. When communism walks in the door democracy flies out the window…

If Redlands Council had a shred of integrity the rating is simple. Take the total amount which would have been received had valuations not increased, then add the rate rise based on inflation etc. and calculate the rates charge based on the new valuations. It is really just an actuarial exercise if this council were truely genuine about the welfare of its residents, and not concentrating on personal aggrandisement with residents assets.